Estate Planning

Markham Business Experts Advising on Estate Planning for a Smooth Transfer of Wealth

For many, estate planning is an uncomfortable topic they tend to avoid. Few people like to consider the complexities and complications that they, their family, and their business could face if the worst should happen. However, planning for the worst-case scenario is a crucial step if you want to ensure that your legacy is protected and your wishes are carried out as you intended.

North America is on the Verge of the Largest Intergenerational Wealth Transfer in History

Over the course of your lifetime, you and your family have accumulated assets and built wealth. In order to be certain that the wealth you built is distributed to the successors you choose and that your legacy and business are protected, a comprehensive estate plan is essential.

A thorough estate plan will ensure your assets and wealth are managed as you intended and that your hard-earned business will be in the hands of the successor you have chosen. When planning to transfer your wealth, there are questions you should consider:

- Who do you want to share in your wealth?

- When and how should your assets become accessible?

- Who will be the successor to your business?

That’s where the experienced personal and business advisors at KSSP Partners LLP can help. It’s never too early to start thinking about your succession plan. Our knowledgeable business experts can create a tailor-made estate plan capable of resolving any complexities or concerns that you and your business need addressed to achieve a smooth transfer of wealth.

Business Succession Planning

Developing a business succession plan is critical in determining how you will transfer your business’ ownership and transition away from a leadership role. Having a solid plan in place will ensure that your business will not be negatively impacted when you are ready to retire or should you experience an unforeseen event.

The trusted advisors at KSSP Partners LLP can help you create a business succession plan that will safeguard your business legacy and ensure it will continue after you are ready to move on.

Estate Planning

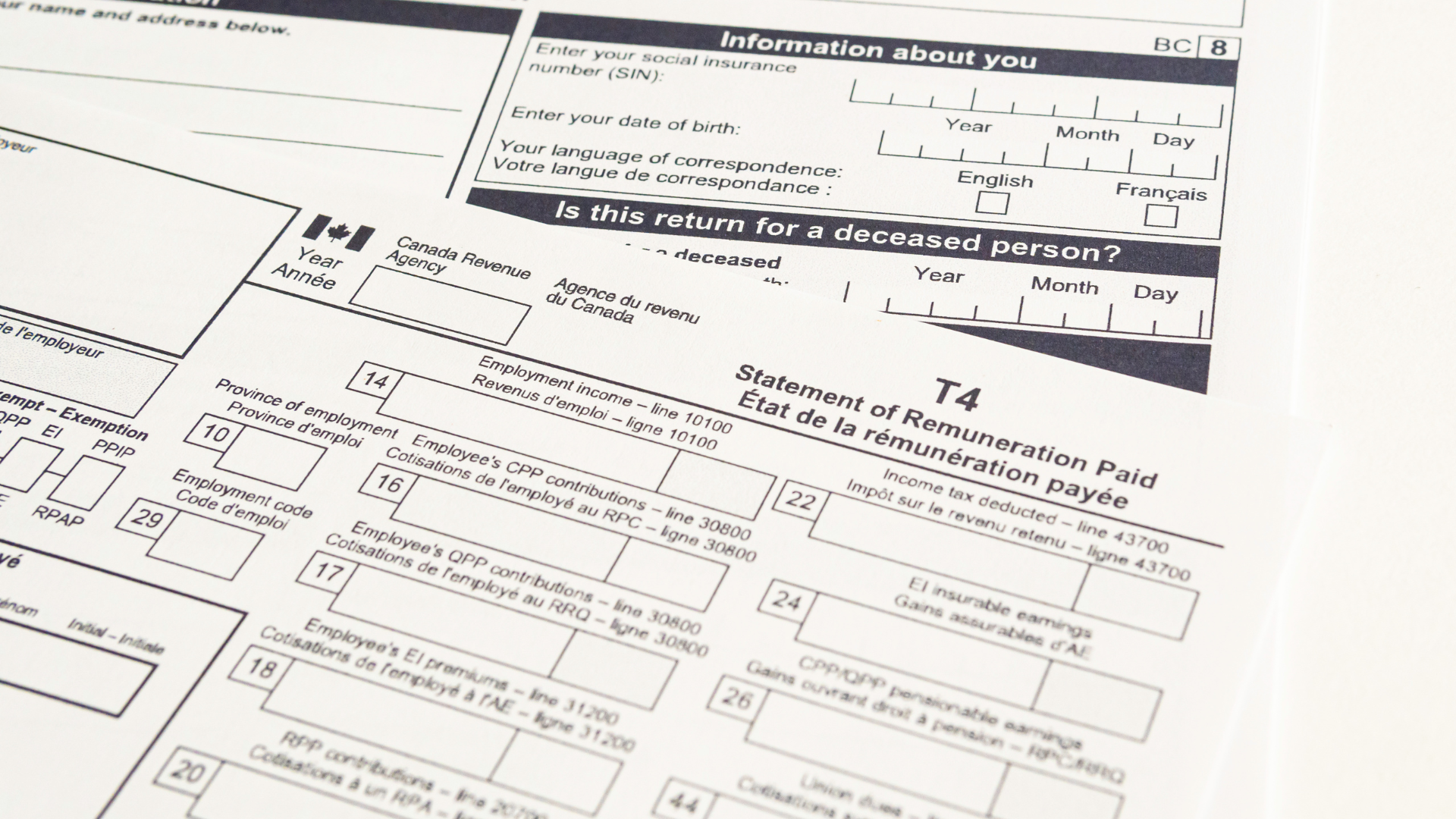

Without a careful and thorough estate plan, there is a risk of exposure to excessive income taxes on your estate as well as an arduous process for the distribution of assets and higher than needed probate fees. We can help you establish a plan that will protect your business’ legacy and ensure financial security for loved ones and key business stakeholders. Let us help you take care of your next generation.

At KSSP Partners LLP, the first step in any estate planning process for our experienced business consultants is to understand what our clients envision for the future to achieve what they want. We then devise a step-by-step plan to ensure the decision-making is optimal for tax purposes and the intended outcome is achieved.

Trusted Markham Business Advisors Providing Estate Planning and Business Succession Solutions Across Ontario

At KSSP Partners LLP, our team of experienced advisors ensures that our client’s wealth is managed as they intended and passed on to their chosen successor. By taking the time to understand our clients’ wishes for the future, we establish an individual plan to meet their individual needs. Let our dedicated team help you develop an estate plan to meet the needs of both you and your business. To learn how we can help you, contact us online or by telephone at 289-554-5997.